Start Earning Daily Cash Back and Power Up Today!1

Open an Account

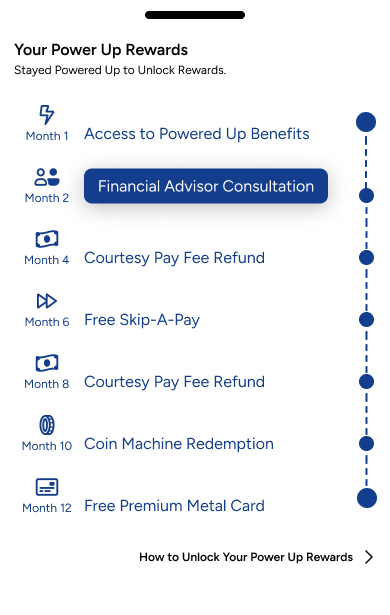

Power Up Rewards

The Power Up rewards program gives you access to a variety of exclusive benefits that make your First Service experience even more rewarding. Every two months, you unlock valuable perks like a free financial advisor consultation, the ability to Skip-a-Pay with no service charge, and Courtesy Pay, a one-time refund on service fees. You’ll also enjoy a free use of our coin machines, making it easy to turn your change into cash. But the best reward comes at 12 months of Power Up — an upgrade to a sleek metal debit card that lets you bank in style! Stay powered up and enjoy these benefits as you continue your journey to financial wellness.

Why Power Up?

In today's world, safeguarding your assets and ensuring your financial well-being is more important than ever. Our Power Up features offer an array of valuable services that go beyond the basics of traditional banking. When you Power Up, you and the loved ones on your account will be empowered with the security and convenience you need, allowing you to focus on what truly matters. Want to get more from your money?

Ready to Power Up?

Log into Digital Banking to activate, or speak with a credit union representative.

Power Up FAQs

- Identity Theft Expense Reimbursement: Receive up to $1,000,000 to help cover expenses associated with restoring your identity, such as attorney fees, loan application fees, long-distance calls, medical records costs, travel and accommodations, lost wages for time taken off work, and more.

- Dedicated Fraud Specialist: Communicate with a dedicated fraud specialist assigned to manage your case and help you every step of the way until your identity is restored.

- Identity Monitoring: Benefit from monitoring of more than 1,000 databases and public records to identify suspicious activity. A risk rating is generated with each monthly scan, and if your scan reflects a high-risk score, you will be notified.

- Daily Credit File Monitoring: Receive daily credit file monitoring and automated alerts of key changes to your Experian, Equifax, and TransUnion credit reports.

- Daily Credit Report and Score: Gain access to credit reports and credit scores. Credit Score is a VantageScore 3.0 based on single credit bureau data. Third parties may use a different type of credit score to assess your creditworthiness.

- Credit Score Tracker: Access to IDProtect® Score Tracker to see changes in your credit score over time.

- Dark Web Monitoring: Monitoring of personal information on the dark web.

- Debit and Credit Card Registration: Register your credit, debit, and ATM cards and enjoy peace of mind knowing you can call one toll-free number to cancel and/or request replacement cards if your cards become lost or stolen.

- Online Resources: Get advice on how to protect yourself from identity theft and access valuable educational resources and news related to identify fraud and credit.

- Buyers Protection: Covers items for 90 days from the date of purchase against accidental breakage, fire, or theft.

- Extended Warranty: Extends the U.S. manufacturer’s original written warranty for up to one full year on most new retail purchases if the warranty is less than five years.